Today’s New York Times includes an article about worried admissions officers across the land, especially at private colleges, who are noticing steep declines in the numbers of applications. Conventional wisdom has it that the financial aid picture is so bad that students dare not dream of attending a private school for fear of being unable to afford it.

While it is true that some of the credit options for parents are a bit sketchy, college still have plenty of financial aid to give away–and perhaps fewer applicants to whom to give it.

What does this mean for you? Well, it means that if you have played your cards right by applying to colleges that are both good fits for you and also likely to accept you, it’s altogether possible that your aid package may be sweetened as an incentive fo you to attend.

If admissions officers sense that they will have a hard time attracting good students, they may rejigger their aid offers in order to ensure that the size of their class does not decline.

It’s also possible that we will see a lot of movement on waiting lists this year, as colleges move to fill their classes in May. This will primarily benefit students who are able to pay and who are not seeking large financial aid packages.

The students I really worry about are the ones who have applied to state colleges in the belief that this is the only place can afford. Not only will classes be super-crowded at state colleges in the fall, but some will not be accepted. And as state funding dries up, some public colleges are capping enrollment. Some may actually accept fewer students in the past, leaving students who thought of their state college as a “safety” school are left hanging.

While it’s impossible to forecast all the craziness that this admissions season will bring, it’s important that students and their parents not lose their senses. Good planning and a good strategy for admissions and financial aid will leave many folks with a variety of good options to choose from once those admissions letters come out in early April.

Mark Montgomery

College Counselor

Ten College Planning Tips For Tough Economic Times

I’ve received a number of questions from readers, clients, and friends about how to navigate the college admissions and financial aid process in tough economic times. By far the biggest worry on everyone’s mind is finding the resources to pay for college.

In some ways we have a perfect storm a-brewing. As personal savings and college funds shrink, colleges are tightening their belts, and are likely to be stingy with financial aid.

So where does that leave the student who will graduate this spring or next? What strategies does he or she pursue in order to get the best education at the best price?

Here are ten tips for weathering this storm.

1. Don’t panic. Keep a cool head. Do your homework. Get help, if you need it. While the statistics look bleak, you are not a statistic. Use every resource at your disposal to plan, prepare, and get the best deal for yourself.

2. Whether the market is up or down, good students always have more options than poor students. Good students with good grades and good test scores should not dampen their ambition or lower their sights.

3. Remember that if your assets and income have gone down, your federally-calculated financial need will go up. Come January, you will complete the FAFSA forms, which will calculate your family’s “Estimated Financial Contribution” or EFC. This is the amount the government calculates that you should be able to pay toward a college education–given your financial picture today.

4. Pay close attention to financial aid statistics reported by colleges, with special emphasis on the percentage of financial need that college has met in the past. Even in good financial times, many colleges have been unable to meet all of their student’s financial need with the usual combination of grants, work study jobs, and federal loans. Most rich, well-endowed colleges and universities can meet 100% of their students’ financial need. But some colleges have met only 80% or 65% or less of their students’ needs. These are the colleges that have relied heavily upon the willingness of students and families to take out huge loans on the private markets. As these loan markets have dried up, these colleges are the most panicked by the economic downturn. Yet even financially strapped colleges may offer big bargains to some students (see tip #6 below).

5. Redefine what a “stretch” or “reach” college will be for you. It’s not simply about getting accepted to college–it’s about being able to pay for it. The tougher it is for you to gain admission, the less likely you will receive adequate financial aid to attend that same school.

6. Develop a “top 25%” strategy that will help increase the likelihood you will get the aid you need. While there is a great deal of variation in financial aid policies, most colleges shower their best financial aid packages on those students in the top 25% of their incoming class. Colleges routinely report the average ACT or SAT test scores by identifying the “middle 50 percent” range of scores of admitted students. So if Elmer Fudd College reports an middle 50% ACT range of 22 to 26, this means 25% of students scored lower than 22, and another 25% scored 27 or higher. An applicant to Elmer Fudd College with an ACT of 29 has a much better chance of receiving a solid financial aid package than the applicant with a 22.

7. Remember that not all debt is bad debt. Racking up tens of thousands of dollars on a credit card is not the same as taking out a Stafford loan. The former is a drag on current and future spending, and high interest rates on credit cards lead to wrack and ruin. But a student loan is an investment in your future. The relatively low interest rate on these loans will allow you to increase your earning potential tomorrow by making it possible to get a good education today. The average student loan debt for graduating college senior is about $20,000, which is an acceptable amount for most students.

8. If you plan to take out a loan to partially finance an education, start shopping for that loan now. Do not wait until admissions decisions are made. Learn what loans are available (or not) so that you can make a realistic plan for how much you can borrow. This knowledge will make it easier to compare financial aid packages later when they are finally announced.

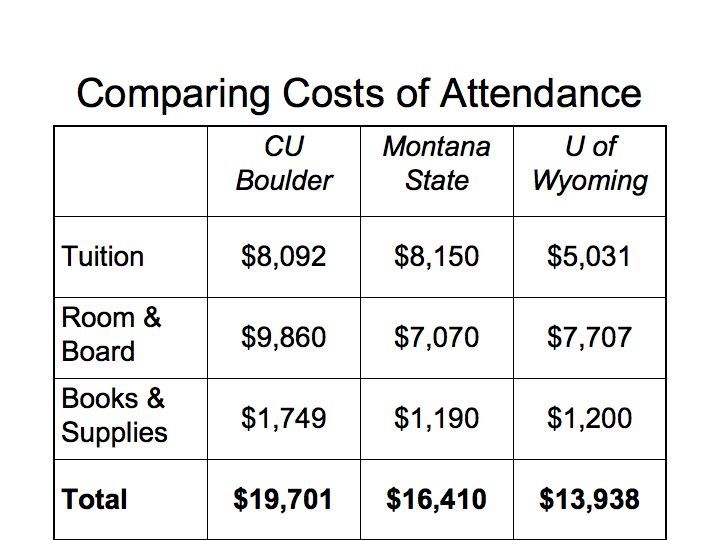

9. Don’t assume that your in-state colleges and universities offer you the best deal. As an example, see my post here about cost comparisons for a Colorado student considering University of Colorado vs. Montana State University or the University of Wyoming.

10. Students with less-than-stellar academic records in high school should consider getting their start at community colleges. Most states now have guaranteed transfer agreements between their community colleges and flagship universities. Go to community college, pay less, do well–and you can still graduate from a top-notch university. In fact, you have a better chance of getting accepted as a transfer if you do well in those general education courses at the community college.

Technorati Tags: college planning, tuition, financial aid, scholarships, financial crisis, credit crisis, Colorado, university Del.icio.us Tags: college planning, tuition, financial aid, scholarships, financial crisis, credit crisis, Colorado, university

College Shopping Tips: When Out-of-State is Cheaper than In-State Tuition

The financial downturn has high school seniors and their parents running scared. How can we reduce costs? How can we get the best deal?

The conventional wisdom says that an in-state college is the cheapest option. As with most conventional wisdom, this assumption is wrong.

Let’s compare costs for a Colorado student considering majoring in business at three state universities in the region.

A few notes explain where these numbers come from:

- CU-Boulder tuition is $10,852, but Colorado students automatically are eligible for the Colorado Opportunity Fund, which effectively reduces tuition by $2760.

- Colorado students with an ACT of 28 or higher attending Montana State are eligible for a tuition discount under the Western Undergraduate Exchange (WUE–pronounced “woo-ee”). Students with even higher ACT scores are eligible for other scholarships that reduce the overall price even further.

- Colorado students attending the University of Wyoming also are eligible for the WUE discount.

Sometimes what you major it makes a difference, too. Business is the most expensive major at CU Boulder. If you major in Arts & Sciences, tuition is less: $7,278 per year. Engineering, however, is $9,568.

So parents, don’t cut off your nose to spite your face! If your student is interested in going out of state to college, do your homework before you assume that staying in state is the cheapest option. Here we have compared only state schools, but even some private colleges will end up costing you less than the University of Colorado at Boulder.

As with most everything in life, it pays to comparison shop!

Technorati Tags: University, Wyoming, Montana, State, Colorado, Boulder, Bozeman, Laramie, tuition, cost, comparison, scholarship, financial aid, scholarships, Del.icio.us Tags: University, Wyoming, Montana, State, Colorado, Boulder, Bozeman, Laramie, tuition, cost, comparison, scholarship, financial aid, scholarships,

Carnival-Palooza

A couple of great carnivals are up that you might want to check out. Check out the Carnival of Homeschooling at Apollo’s Academy where my post about how the credit crunch may affect college admissions this cycle.

The same post was featured in the Carnival of Linked-In Users at Janet Barclay’s blog. This is an eclectic carnival that features a huge variety of interesting articles from around the blogosphere.

Blog Carnivals are a great way to share your best blog posts. If you’re interested in contributing to the Carnival of College Admission, make sure to submit the URL of a recent blog post to the handy-dandy Blog Carnival submission form. The next edition of the Carnival of College Admission will go up on November 12th.

Mark Montgomery

The Credit Crunch and Financial Aid: What Will It Mean for College Admissions?

The press is full of startling articles about the impact of the economic downturn on financial aid. For example, George Washington University is likely to transfer a portion of its financial aid budget for next year to students currently enrolled. The private university fears that a significant portion of its student may have to leave before finishing their degrees because families’ savings have been decimated by the market plunge.

This fear is justifiable. During a recent visit to the University of San Diego, I noticed that the front page of the student newspaper, The Vista, included a lengthy feature about USD students who were worried they might have to withdraw because their parents could no longer afford to pay their tuition bills.

Other examples abound. According to an article on the KOMU website (a Missouri television station affiliated with the University of Missouri), more students are choosing to live at home to economize. Even with the high cost of gas, students can save money by commuting, rather than living in the dormitories. At Mizzou, for example, room and board can cost $7500, which is about the cost of an entire year’s tuition.

The Miami Herald also ran a recent story about a student who dreamed of attending Bennington College in Vermont (with a tuition sticker price of a whopping $49,000 per year), but who will likely end up attending a state institution in Florida.

The National Association of Independent Colleges and Universities (NAICU) conducted a survey of member institutions in September 2008, and reported the following findings.

While there was no widespread student loan crisis through September, there were multiple instances of students taking time off of school, switching to part-time status, and turning to alternative forms of financial support than reported in NAICU’s March survey. There was a considerable amount of behind-the-scenes scrambling by private colleges to keep loan capital flowing to their students.

But what these financial difficulties mean for admissions offices? Clearly financial aid budgets will be constrained, especially if other colleges like George Washington University move funds to support students already enrolled. Fewer financial aid dollars will remain to support incoming freshmen.

So what does all this mean for students and parents who are in the midst of the admissions cycle? While it’s impossible to make too many assumptions at this point, here are a few possible effects.

1. Fewer colleges will be able to make a legitimate promise not to consider financial need in the admission process. Many colleges and universities claim that their admissions processes are “need blind” (though very few really are: financial need always enters the admissions process in one way or another). This year, admissions offices will be more aware of financial need than in the recent past.

2. Students whose families can pay the full cost of tuition will likely have an advantage in the admissions process, while students who must depend on merit aid and other grants to attend will find their aid packages insufficient to allow them to attend.

3. Full-pay students whose academic profile (high school grades and test scores) place them below the historical institutional averages may find that they have a better chance of admission this year than last.

4. As a result, colleges may see an erosion of their admissions statistics. For example, at George Washington University, the average SAT has been 640, and the average ACT has been about 28. This year, in order to make its budget and attract enough paying students, GWU may have to lower its standards a bit to ensure a full incoming freshman class. One could foresee, for example, GWU’s average GPA falling by one or two tenths, and its average SAT declining by 50 to 70 points, and its average ACT falling by a point or two.

5. State institutions may actually become more competitive, as the number of applications to in-state public universities soars. Fearing that more students than usual will accept offers of admission—which could result in overcrowding—admissions offices at public universities may accept a smaller percentage of applicants at first, and then use their waiting lists just in case they miscalculate their yield rates.

6. Waiting lists may be longer at private universities. Admissions and financial aid officers will watch their yield rate carefully from April to May. If more accepted students decline offers of admission than in the past, we can expect colleges turn to their waiting lists in order to fill their class and make their budget. And financial aid packages are always much less for students pulled from the waiting list.

7. With fewer grant dollars (or “discounts”) available, more students may find that their financial aid package includes more loans than they might have received in the past. This is somewhat paradoxical, given that fewer student loans may be available from private institutions (federal loans are still available, but the amounts are capped).

8. Financial aid offices are unlikely to be able to meet as much demonstrated need as in the past. (Recall that a family’s “demonstrated need” is the difference between the cost of attendance and the “expected family contribution,” or EFC, as calculated by the Federal government on the FAFSA). For example, GWU has met about 90% of demonstrated need in the recent past. In the coming year, GWU may meet only 70-80% of need—or less—depending on how much financial aid money it has to move to subsidize students currently enrolled.

Of course, it’s difficult to prognosticate. But given the buzz in the higher education press and my understanding of the university budgeting and admissions processes, we can certainly deduce that this year will be a wild one for high school seniors and their families. And it will also be a wild one for admissions and financial aid offices around the country as we all adjust to a new economic landscape.

Mark Montgomery

Technorati Tags: credit crunch, financial aid, scholarships, college, university, admission, NAICU, George Washington, Missouri, Bennington, San Diego Del.icio.us Tags: credit crunch, financial aid, scholarships, college, university, admission, NAICU, George Washington, Missouri, Bennington, San Diego

Falling Stock Markets and College Budgets: Mergers & Bankruptcies on the Horizon?

Forbes posted an article on October 22, foretelling hard times in the country’s higher education industry. With falling stockmarkets, declining endowments, and some colleges having loaded up with debt in the past decade or so, the article predicts that some colleges may be swallowed up by financially stronger competitors, or will at the very least face some very tough financial difficulties in the next few years.

The evidence is a September 2008 study by the National Association of Independent Colleges and Universities, in which one-third of the 504 member institutions surveyed indicated that the credit crunch had hurt enrollment. About 20% of respondents said they had fewer returning students than expected, and roughly the same number said they had a smaller incoming freshman class than expected.

Clearly the credit crunch is hurting individual families, and economic logic would have it that these individual decisions will have an impact on the higher education industry, as demand falls for high-priced tuition at private colleges and universities. I’ll have more thoughts on that story later this week.

As demand falls, some colleges that were not as conservative with their investments and did not leverage their future in favor of immediate gratification may begin to feel the financial pinch. Moody’s is watching college budgets and investments carefully, and according to an article in the Chronicle of Higher Education, three colleges are on a “watch list” to have their bond ratings downgraded. The colleges in question are Simmons College, Franklin Pierce University, and Suffolk University.

Many other colleges will feel some pain. But, as I said in an earlier post, most colleges have acted more like the pecunious ant than the spendthrift grasshopper. The report from Moody’s bears this out, as seen from this quotation from the Chronicle article:

In its report, Moody’s said that the “overwhelming majority” of colleges have dealt with the freeze with “only minor budgetary or liquidity adjustments.” It attributed colleges’ general resilience to their conservative management strategies, their access to lines of credit and quasi-endowment funds, and their holding of fixed-rate debt.

So I’m not betting that many colleges will go belly up or that we’ll see a bunch of college mergers. Maybe a few exceptional cases will make the headlines, but the vast majority will weather the storm. It won’t necessarily be a leisurely cruise; but most boats won’t sink–even as the hurricane roars overhead.

Mark Montgomery

College Counselor

Technorati Tags: Moody’s, bonds, Wachovia, college, university, endowment, endowments, credit crunch Del.icio.us Tags: Moody’s, bonds, Wachovia, college, university, endowment, endowments, credit crunch

Paying for College in a Credit Crunch

Lisa Belkin, a writer and blogger for the New York Times, has a couple of posts on her blog yesterday about the general angst and real effects on families’ decisions about college. For those who have graduating seniors who have seen their savings dry up, it has been a sobering–even depressing–few weeks.

I recommend Amy’s posts. The first part is here, and the second part is here.

Mark Montgomery