Applying to an out-of-state public university can be a good admissions strategy. However, it may not be the smartest financial move.

Continue readingPublic Colleges and the Economic Crisis

An interactive map published by US News and World Report can help families determine which states are headed towards budget cuts. The map could also help students determine which schools may want to increase their enrollment of out-of-state students.

Continue readingOut-of-State Public Universities–A Good Idea?

Today’s issue of Inside Higher Ed has an article about public universities eager to boost revenues–and head count–by recruiting out-of-state students.

Many public universities are facing deep budget cuts, and some are hoping to make up their revenue shortfalls by recruiting out-of-state students. The article expresses many doubts that this will be a good strategy for most state universities.

One of the doubts–raised by me, as I was quoted in the article–is that most students from the west and south who desire to go out-of-state for college are looking at either the most prestigious and reputable public universities (Virginia, Michigan, North Carolina) or at the private colleges and universities. Why, for example, would a qualified Colorado student choose the University of Massachusetts at Amherst (at out-of-state tuition prices) when he can go to the University of Colorado at Boulder?

I also pointed out that some public universities closer to home may be attractive to some students, especially if they offer generous scholarship programs. The University of Wyoming and Montana State University, for example, offer great packages to some students to attract them to their campuses.

But it seems unlikely that many state universities will be able to make significant increases in their out-of-state applicants.

With budgets being cut back, might it actually be time to reassess how many university slots a state actually needs? If there is more supply than demand, then why not cut back the supply to match that demand?

Or, might it make more sense for a UMass-Amherst to put more energy into retaining and graduating students within six years? For example, recent data suggest that only 84% of freshmen at UMass-Amherst return for their sophomore year. If UMass could raise that to 93% (which is the first-year retention rate at University of Washington-Seattle), it would be able to make up a heck of a lot of revenue that way.

Similarly, only 68% of entering freshmen at UMass will graduate in six years. If UMass could raise that rate to, say 78% (which is the six-year graduation rate at the University of Texas-Austin), the university would fill quite a few holes in its budget.

Sometimes the solution to a problem is closer at hand than we think.

Mark Montgomery

College Counselor

Ten College Planning Tips For Tough Economic Times

I’ve received a number of questions from readers, clients, and friends about how to navigate the college admissions and financial aid process in tough economic times. By far the biggest worry on everyone’s mind is finding the resources to pay for college.

In some ways we have a perfect storm a-brewing. As personal savings and college funds shrink, colleges are tightening their belts, and are likely to be stingy with financial aid.

So where does that leave the student who will graduate this spring or next? What strategies does he or she pursue in order to get the best education at the best price?

Here are ten tips for weathering this storm.

1. Don’t panic. Keep a cool head. Do your homework. Get help, if you need it. While the statistics look bleak, you are not a statistic. Use every resource at your disposal to plan, prepare, and get the best deal for yourself.

2. Whether the market is up or down, good students always have more options than poor students. Good students with good grades and good test scores should not dampen their ambition or lower their sights.

3. Remember that if your assets and income have gone down, your federally-calculated financial need will go up. Come January, you will complete the FAFSA forms, which will calculate your family’s “Estimated Financial Contribution” or EFC. This is the amount the government calculates that you should be able to pay toward a college education–given your financial picture today.

4. Pay close attention to financial aid statistics reported by colleges, with special emphasis on the percentage of financial need that college has met in the past. Even in good financial times, many colleges have been unable to meet all of their student’s financial need with the usual combination of grants, work study jobs, and federal loans. Most rich, well-endowed colleges and universities can meet 100% of their students’ financial need. But some colleges have met only 80% or 65% or less of their students’ needs. These are the colleges that have relied heavily upon the willingness of students and families to take out huge loans on the private markets. As these loan markets have dried up, these colleges are the most panicked by the economic downturn. Yet even financially strapped colleges may offer big bargains to some students (see tip #6 below).

5. Redefine what a “stretch” or “reach” college will be for you. It’s not simply about getting accepted to college–it’s about being able to pay for it. The tougher it is for you to gain admission, the less likely you will receive adequate financial aid to attend that same school.

6. Develop a “top 25%” strategy that will help increase the likelihood you will get the aid you need. While there is a great deal of variation in financial aid policies, most colleges shower their best financial aid packages on those students in the top 25% of their incoming class. Colleges routinely report the average ACT or SAT test scores by identifying the “middle 50 percent” range of scores of admitted students. So if Elmer Fudd College reports an middle 50% ACT range of 22 to 26, this means 25% of students scored lower than 22, and another 25% scored 27 or higher. An applicant to Elmer Fudd College with an ACT of 29 has a much better chance of receiving a solid financial aid package than the applicant with a 22.

7. Remember that not all debt is bad debt. Racking up tens of thousands of dollars on a credit card is not the same as taking out a Stafford loan. The former is a drag on current and future spending, and high interest rates on credit cards lead to wrack and ruin. But a student loan is an investment in your future. The relatively low interest rate on these loans will allow you to increase your earning potential tomorrow by making it possible to get a good education today. The average student loan debt for graduating college senior is about $20,000, which is an acceptable amount for most students.

8. If you plan to take out a loan to partially finance an education, start shopping for that loan now. Do not wait until admissions decisions are made. Learn what loans are available (or not) so that you can make a realistic plan for how much you can borrow. This knowledge will make it easier to compare financial aid packages later when they are finally announced.

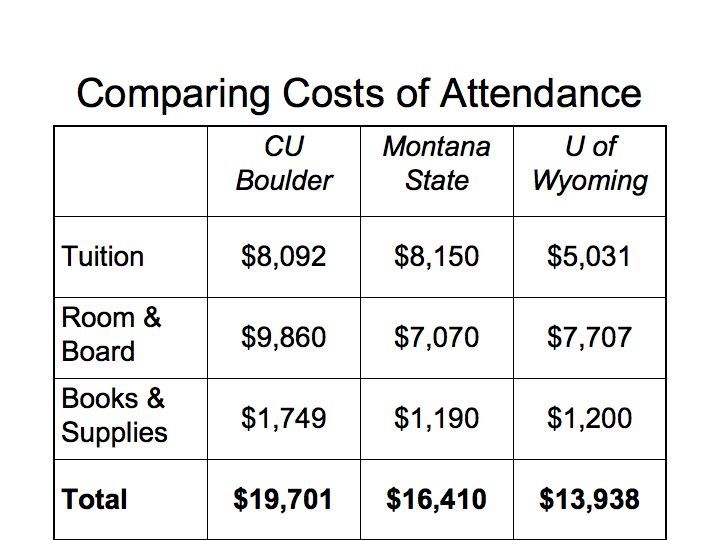

9. Don’t assume that your in-state colleges and universities offer you the best deal. As an example, see my post here about cost comparisons for a Colorado student considering University of Colorado vs. Montana State University or the University of Wyoming.

10. Students with less-than-stellar academic records in high school should consider getting their start at community colleges. Most states now have guaranteed transfer agreements between their community colleges and flagship universities. Go to community college, pay less, do well–and you can still graduate from a top-notch university. In fact, you have a better chance of getting accepted as a transfer if you do well in those general education courses at the community college.

Technorati Tags: college planning, tuition, financial aid, scholarships, financial crisis, credit crisis, Colorado, university Del.icio.us Tags: college planning, tuition, financial aid, scholarships, financial crisis, credit crisis, Colorado, university

College Shopping Tips: When Out-of-State is Cheaper than In-State Tuition

The financial downturn has high school seniors and their parents running scared. How can we reduce costs? How can we get the best deal?

The conventional wisdom says that an in-state college is the cheapest option. As with most conventional wisdom, this assumption is wrong.

Let’s compare costs for a Colorado student considering majoring in business at three state universities in the region.

A few notes explain where these numbers come from:

- CU-Boulder tuition is $10,852, but Colorado students automatically are eligible for the Colorado Opportunity Fund, which effectively reduces tuition by $2760.

- Colorado students with an ACT of 28 or higher attending Montana State are eligible for a tuition discount under the Western Undergraduate Exchange (WUE–pronounced “woo-ee”). Students with even higher ACT scores are eligible for other scholarships that reduce the overall price even further.

- Colorado students attending the University of Wyoming also are eligible for the WUE discount.

Sometimes what you major it makes a difference, too. Business is the most expensive major at CU Boulder. If you major in Arts & Sciences, tuition is less: $7,278 per year. Engineering, however, is $9,568.

So parents, don’t cut off your nose to spite your face! If your student is interested in going out of state to college, do your homework before you assume that staying in state is the cheapest option. Here we have compared only state schools, but even some private colleges will end up costing you less than the University of Colorado at Boulder.

As with most everything in life, it pays to comparison shop!

Technorati Tags: University, Wyoming, Montana, State, Colorado, Boulder, Bozeman, Laramie, tuition, cost, comparison, scholarship, financial aid, scholarships, Del.icio.us Tags: University, Wyoming, Montana, State, Colorado, Boulder, Bozeman, Laramie, tuition, cost, comparison, scholarship, financial aid, scholarships,