What’s the easiest and most fun way to avoid student debt and college loans then you can’t pay tuition for a dream school? Check out this upcoming movie.

Continue readingAre College and Universities Bankrupting Themselves?

NYU and Columbia have announced plans to expand by taking on more debt in these tough economic times. Does this really make good financial or educational sense?

Continue readingA Caution About Student Loans

Is taking out a student loan a good investment? Some think it is a good idea to stay away from student loans in order to finance a college education.

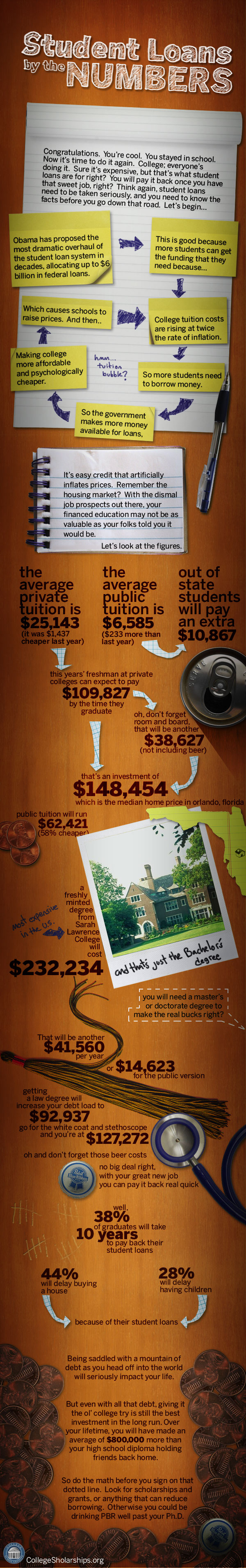

Continue readingStudent Loans By the Numbers

CollegeScholarships.org has a great new graphic that helps you think about the value (and the cost) of a college education. It’s definitely a great tool to help you conceptualize the costs, and to really consider whether it’s wise to take out a ton of loans to finance your undergraduate education.

The folks there said I could share it with you. So, have a look!

Mark Montgomery

College Consultant

Technorati Tags: financial aid, scholarships, college, university, admission, student loan, student loans Del.icio.us Tags: financial aid, scholarships, college, university, admission, student loan, student loans

New Student Loans Require Payments While in School

Sallie Mae, the largest private lender in the student loan market, will no longer defer interest until graduation. Starting today, all new student loans require payments while in school.

Payments while in school will be up to $160 per month. Payments after graduation will also go up, from $250 to $328 (but with a shorter repayment term of 15 instead of 30 years).

Some people will be up in arms about this “huge change” in student lending.

But I prefer to look at this is a healthy change: the student loan business in the past has been just as dodgy as the home mortgage business, and students and their families have been much too willing to take out larger loans than necessary to finance a quality college education.

The new Sallie Mae provisions may help reorient expectations. Of course, the changes won’t be without their negative consequences.

Some deserving students at the lower end of the socio-economic scale may have less access to funds. But these same students, if they are talented, also have access to greater need-based aid and Pell grants.

I think the biggest losers, actually, will be some of the third and fourth-tier private colleges that have ridden high in the past decade or so, due to the demographic bubble and the willingness of families to gorge themselves on student loans. Some tuition-driven colleges may find they have fewer students to fill their beds in the future.

Mark Montgomery

Educational Consultant

Technorati Tags: student loan, financial aid, Sallie Mae, college admission, college selection, debt, mortgage Del.icio.us Tags: student loan, financial aid, Sallie Mae, college admission, college selection, debt, mortgage

The Benefits (and Risks) of a GAP Year In Tough Economic Times

The New York Times carried an article yesterday, entitled

Delaying College for a Year Could Have Benefits, which lays out a few creative reasons for putting off college for a year.

The financial arguments boil down to this:

1. President Obama’s proposed changes to federal student aid may put a few hundred dollars more per year in a student’s coffers (of course, the plan will have to get through Congress first…but perhaps, “yes, it can”).

2. The economy could get a bit better, meaning that money Mom and Dad have set aside might be worth a bit more tomorrow than it is today (of course, it could also be worth less…but who wants to think that way?).

As the article attests, it is tough to get many students pumped up about a Gap Year, because it just “isn’t the norm.” However, I like the idea of a Gap Year for many students who really don’t have a solid direction, who maybe don’t love school so much and need a break, or for kids who want to take advantage of their youth while they still have it.

If I had it to do all over again, I’d certainly take a Gap Year. In fact, I’d like to take a Gap Year now.

What is that quotation about how youth is wasted on the young? Who said that?

Mark Montgomery

Educational Consultant

Technorati Tags: Gap Year, college, admission, financial aid, Obama, student loan, federal Del.icio.us Tags: Gap Year, college, admission, financial aid, Obama, student loan, federal

Taking Out a Student Loan? Listen To This First!

OnPoint, a radio production of WBUR and NPR, ran a story this past week called The Dark Side of Student Loans. The featured guest is Alan Michael Collinge, founder of StudentLoanJustice.org and author of the new book “The Student Loan Scam: The Most Oppressive Debt in U.S. History – and How We Can Fight Back.” Publisher’s Weekly apparently calls it “whistle-blowing at its finest.”

This story should be required listening for any student or parent considering taking out a student loan to pay for college tuition and expenses.

Parents and students should, indeed, consider “return on investment” before enrolling in an expensive degree program.

But more than that, parents and students should develop a decent strategy of selecting the right college BEFORE they get admitted and are faced with a lousy financial aid package. Do the research! Don’t just sign the loan papers and then plead, “gosh, I had no idea!”

As I have written many times, colleges and universities are businesses. They act like businesses. They talk about “filling beds” and “sales leads.” And yes, they use financial aid programs to their advantage…not to the advantage of the student. This is not really surprising, is it?

What is surprising is that too few families have blinkers on when it comes to financing a college education. Doing some solid research well before the applications are submitted will help mitigate the anger and hurt (and debt) that can come after the diploma is framed.

Technorati Tags: financial aid, student loan, college admission, college counseling, college consulting, college coach, educational planner Del.icio.us Tags: financial aid, student loan, college admission, college counseling, college consulting, college coach, educational planner

Choose the Right College Before Tackling the Financial Aid Form

An article the other day in the New York Times highlights the pain of applying for financial aid. Entitled “The Big Test Before College,” the article raises the issue of whether the intimidating form actually does what it is supposed to do: measure a family’s financial need.

While we all love to hate these “means tests,” it’s hard to conceive of a way to simplify this process too much. Furthermore, one must remember that the FAFSA is later interpreted by individual colleges as they decide how much aid to give to families.

The FAFSA (or its eventual replacement) will churn out the “Estimated Family Contribution” (EFC). But colleges–especially private ones–will always have the power to decide whether to meet full financial need, and with what financial instruments (grants, loans, work study, arm, leg, promise of first born, etc.).

Thus choosing a college carefully before applying is essential. Too many families encourage their children to apply to whatever college they like, with the promise, “don’t worry, honey, we’ll figure out how to pay for it somehow.” The result is anxiety, disappointment, and a complete surrender of control to the college admissions and financial aid offices.

It doesn’t have to be this way. With some careful planning, honest appraisal of financial priorities, and open communication within a family, students and parents can find the colleges that will be more likely to meet their financial need, and ensure that the student receives an excellent undergraduate education.

Advice for Completing FAFSA Form for Financial Aid

One of the most daunting tasks in the college admission and financial aid process is completion of the FAFSA, the Free Application for Federal Student Aid. A colleague forwarded this link to a great video that explains what the FAFSA is and how to complete it in five entertaining minutes. Have a look.

Okay, it glosses over the details (which may lead to hair loss among some parents). But at least it points out how important this form is in helping families get the best financial aid packages possible.

Technorati Tags: financial aid, FAFSA, tuition, grant, scholarship, loan, student

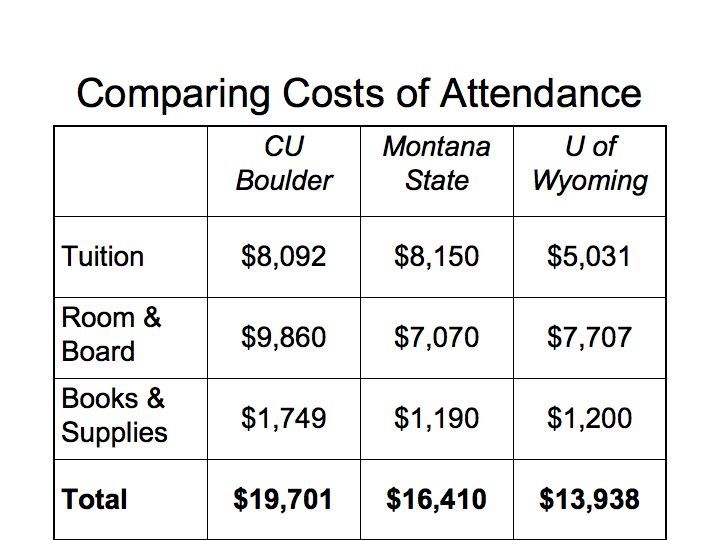

College Shopping Tips: When Out-of-State is Cheaper than In-State Tuition

The financial downturn has high school seniors and their parents running scared. How can we reduce costs? How can we get the best deal?

The conventional wisdom says that an in-state college is the cheapest option. As with most conventional wisdom, this assumption is wrong.

Let’s compare costs for a Colorado student considering majoring in business at three state universities in the region.

A few notes explain where these numbers come from:

- CU-Boulder tuition is $10,852, but Colorado students automatically are eligible for the Colorado Opportunity Fund, which effectively reduces tuition by $2760.

- Colorado students with an ACT of 28 or higher attending Montana State are eligible for a tuition discount under the Western Undergraduate Exchange (WUE–pronounced “woo-ee”). Students with even higher ACT scores are eligible for other scholarships that reduce the overall price even further.

- Colorado students attending the University of Wyoming also are eligible for the WUE discount.

Sometimes what you major it makes a difference, too. Business is the most expensive major at CU Boulder. If you major in Arts & Sciences, tuition is less: $7,278 per year. Engineering, however, is $9,568.

So parents, don’t cut off your nose to spite your face! If your student is interested in going out of state to college, do your homework before you assume that staying in state is the cheapest option. Here we have compared only state schools, but even some private colleges will end up costing you less than the University of Colorado at Boulder.

As with most everything in life, it pays to comparison shop!

Technorati Tags: University, Wyoming, Montana, State, Colorado, Boulder, Bozeman, Laramie, tuition, cost, comparison, scholarship, financial aid, scholarships, Del.icio.us Tags: University, Wyoming, Montana, State, Colorado, Boulder, Bozeman, Laramie, tuition, cost, comparison, scholarship, financial aid, scholarships,